|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance Take Equity Out: A Comprehensive Guide to Cash-Out RefinancingRefinancing your home to take equity out, also known as cash-out refinancing, is a financial strategy that allows homeowners to access the equity they've built up in their property. This guide will explore the process, benefits, and considerations of cash-out refinancing. Understanding Cash-Out RefinancingCash-out refinancing replaces your existing mortgage with a new one, typically for a larger amount. The difference is paid out to you in cash, which you can use for various purposes such as home improvements, debt consolidation, or other financial needs. How It WorksWhen you refinance, your new loan amount is based on your home's current value, minus any outstanding mortgages. The difference between the new loan amount and the old mortgage is the cash you receive. Benefits of Cash-Out Refinancing

Considerations Before RefinancingIt's crucial to consider the costs and risks associated with refinancing. This includes closing costs, changes in interest rates, and the impact on your overall financial situation.

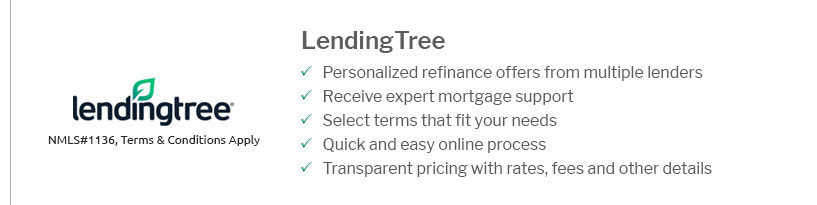

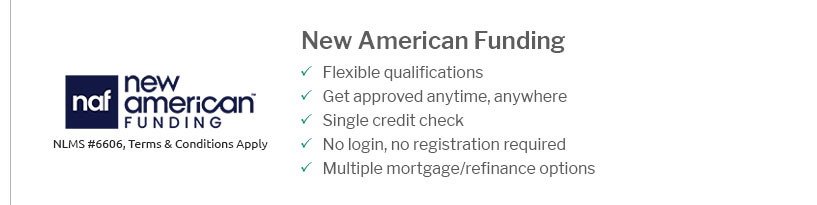

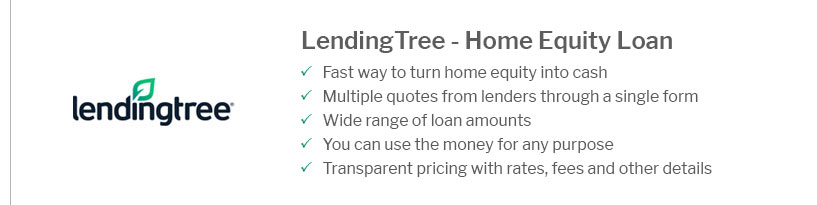

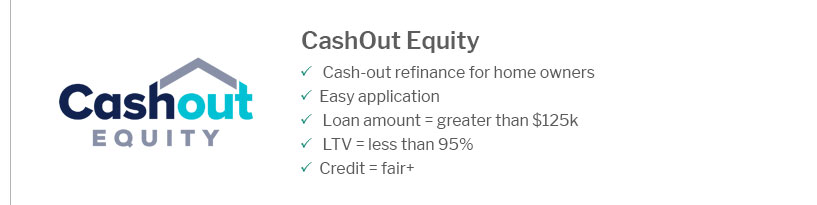

For those interested in exploring options, check out the best FHA cash out refinance lenders for competitive rates and terms. Who Should Consider Cash-Out Refinancing?Homeowners with significant equity and a stable financial situation might find cash-out refinancing beneficial. It's an ideal option for those looking to finance large expenses or consolidate debt without taking out a separate loan. FAQWhat is the maximum amount I can cash out?The maximum amount depends on your home's equity and the lender's policies. Typically, lenders allow you to borrow up to 80% of your home's value. Is a cash-out refinance a good idea?It can be a good idea if you need funds for significant expenses or debt consolidation and if the terms of the new loan are favorable. However, it is important to consider the long-term impact on your financial health. How does cash-out refinancing affect my interest rate?Your interest rate may increase or decrease depending on current market conditions and your credit profile. It's essential to compare rates with those from the best FHA refinance lenders. https://rocketmortgage.ca/learning-centre/refinance-and-renewal/equity-take-out-refinance/

How Equity Take-Out Refinancing Works. As with any type of mortgage refinance, an equity take-out refinance involves replacing your existing ... https://www.unison.com/blog/cash-out-refinance-alternatives

In contrast, a cash-out refinance replaces your current mortgage with a new one, so you can use the remaining balance for your financial needs. Overall, a cash- ... https://www.td.com/us/en/personal-banking/mortgage-cash-out-refinance-vs-home-equity-financing

In a mortgage cash-out refinance, you'll replace your existing mortgage with a new home loanand get the difference between the two in a lump sum of cash ...

|

|---|